Knowledge Center

You want it to be the best quality, comfortable and value for money whether it is a car, a house or a small pen. When it comes to investment, which instrument would you choose?

The world’s best avenue for investment right now is Mutual Funds.

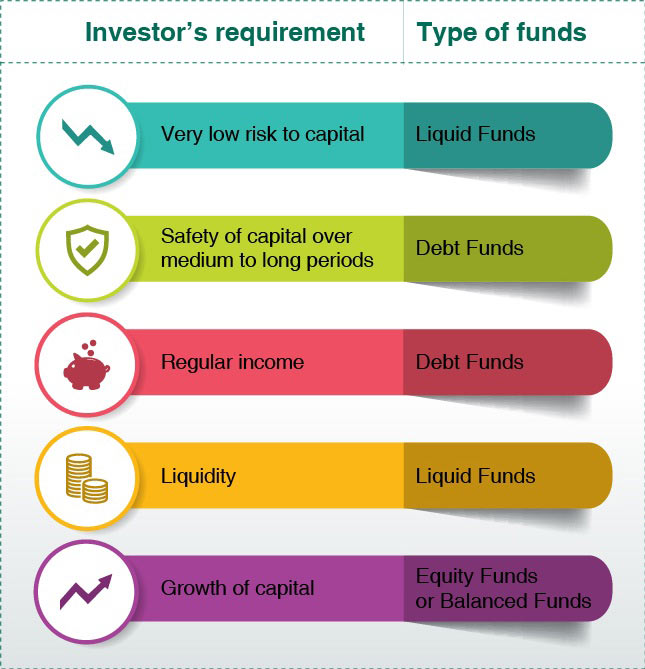

You invest in various investment avenues based on your requirements

For capital growth

For safety of capital and regular income

The concern for most investors is: how to know which instruments are best for them? One may not have enough abilities, time or interest to conduct the research.

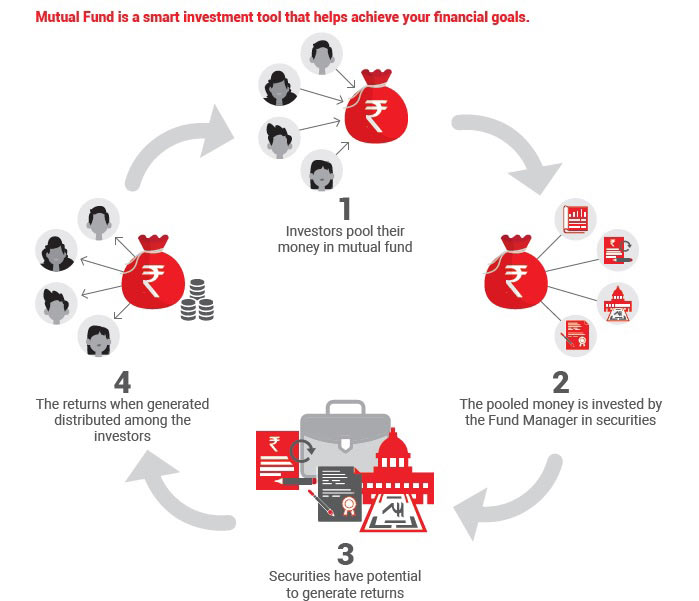

An investor can outsource ‘managing one’s investments’ to a professional firm – the Mutual Fund Company.

Let's see what a mutual fund is:

Mutual Fund Broad Categorization

If you want to select a winning basketball team, which players would you pick?

The players with 5 feet height

OR

The ones with 7 feet height

Obviously 7 feet tall players.

Mutual fund is the seven feet tall basketball team amongst all investment avenues which is a win-win situation.

Mutual Fund vs FD vs Saving account

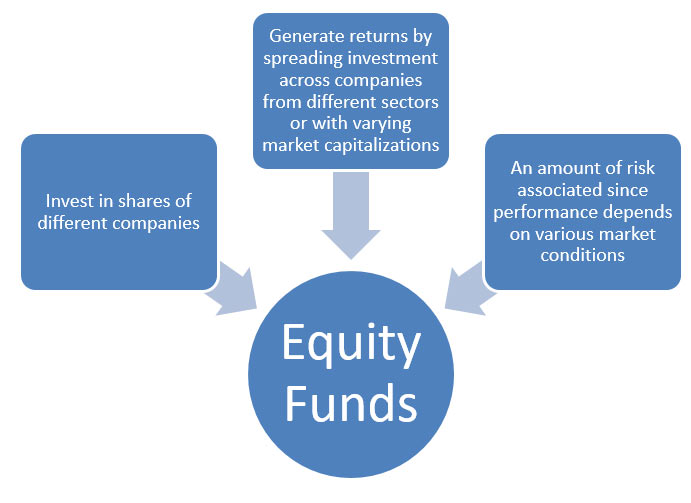

Selecting asset class with highest returns? Equity Mutual Funds is the answer!

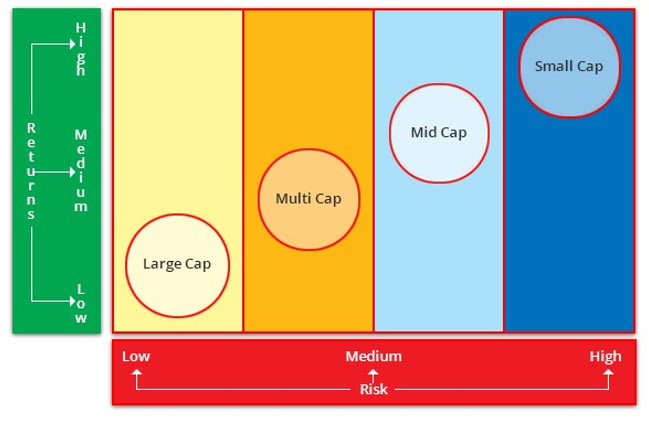

Risk Return trade-off

Disclaimer: There is always a market risk involved in all types of market caps. It may happen that the large caps outperform mid and small caps in some situations. Over a longer period of time, the mid and small caps may deliver better returns than large caps.

Long term investment

When to buy and when to sell? A big question

The great market Guru ‘Warren Buffet’ has come to your rescue.

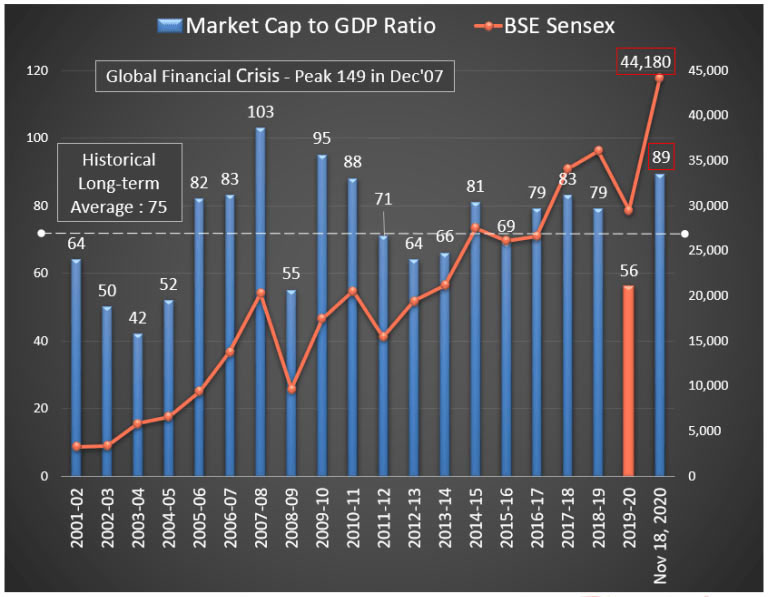

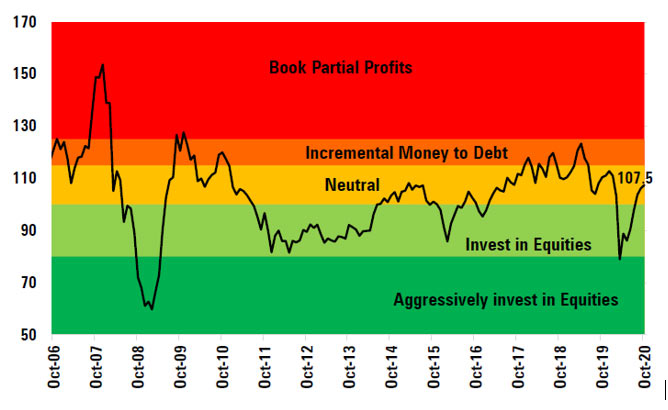

Market Cap to GDP Ratio, also popularly known as the Buffett Indicator is used to assess the valuations of the stock markets.

Investing in FD?

Major chunk of population feels FD is the safest investment option with good returns. In the current scenario, FD returns range from 4.5-6% in large public sector or private sector banks and an investor has to pay heavy taxes on FD returns. Returns after taxation should at least beat inflation.

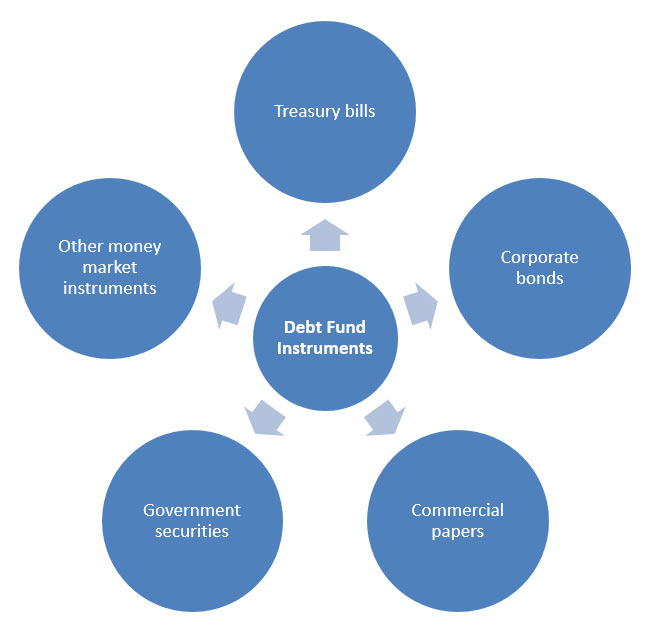

Debt Funds are good alternative with higher returns, greater liquidity and better taxation

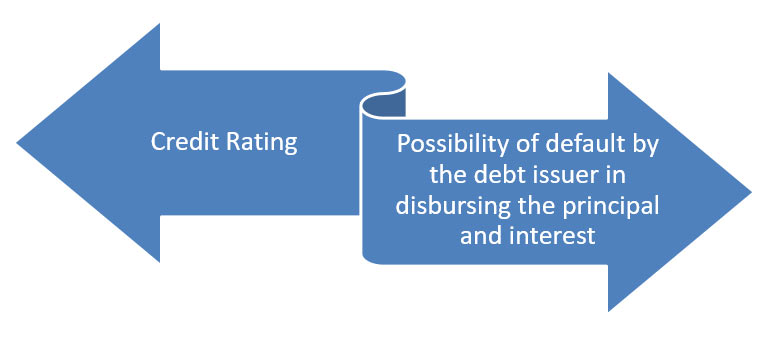

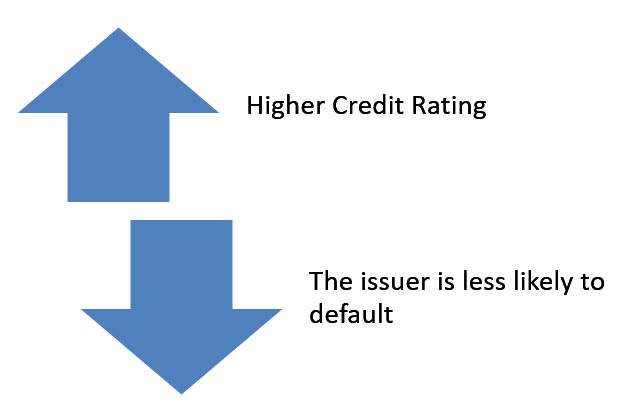

Debt Funds and credit rating

It is obvious to have a logical question:

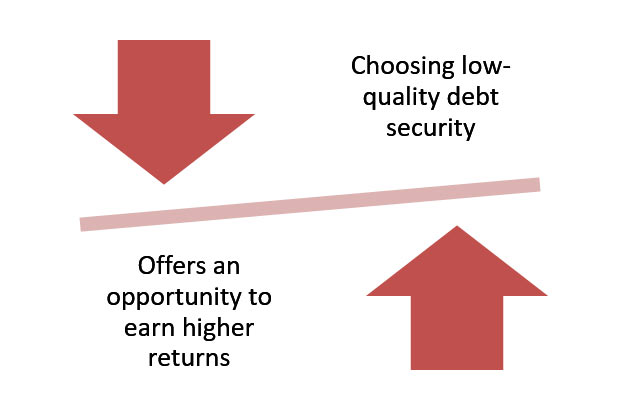

Do Debt Funds also invest in low-quality debt instruments?

The answer is yes. And the best example is the recent debt fund fiasco by a big fund house.

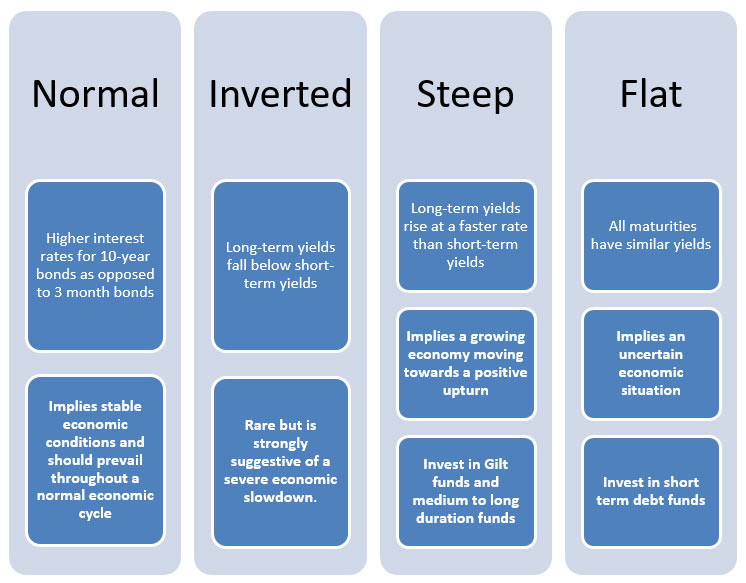

Debt Fund Managers choose to invest in long-term or short-term debt securities depending on whether interest rate regime is falling or rising.

Investing in high-quality securities makes portfolio more stable.

Are you investing in RDs and not satisfied with the returns?

Debt fund SIPs are a better alternative. Depending you time horizon and your risk-reward ratio, you can choose debt fund scheme.

Few interesting things related to debt funds

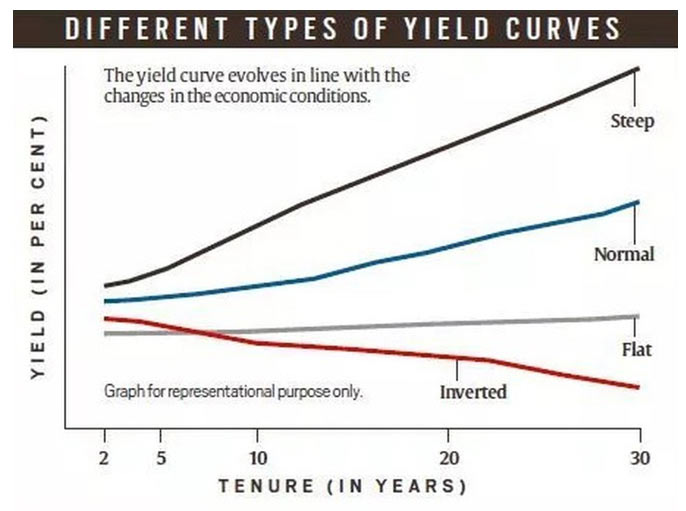

Yield curve

A yield curve is a line that plots yields (interest rates) of bonds having equal credit quality but differing maturity dates. The slope of the yield curve gives an idea of future interest rate changes and economic activity. There are four main types of yield curve shapes:

Yield Curve Simplified

After the recent debt fund fiasco by a big mutual fund house, you must be wondering which debt fund to select. Here are few factors you can use to select debt funds.

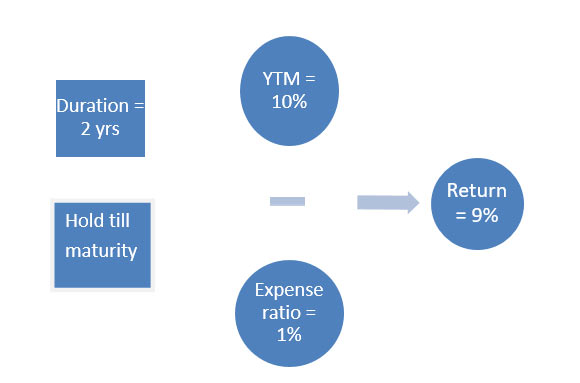

Yield to Maturity:

Yield to maturity (YTM) is the return which a bond investor will get by holding the bond to maturity. For a debt fund, it is the return which the fund will get by holding the securities in its portfolio to maturity.

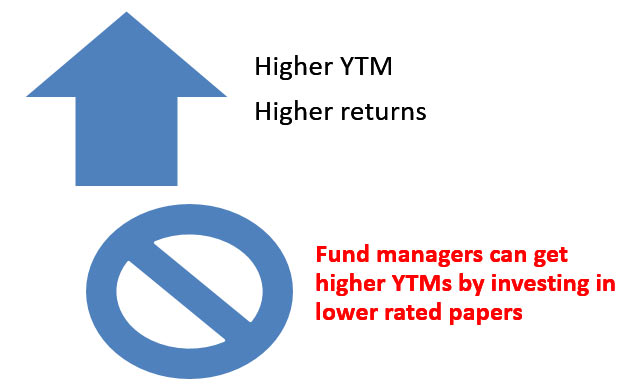

YTM for investing

Therefore, you should make sure that you are comfortable with the credit risk of the fund. You can find the credit risk profile of a fund’s securities in the factsheet. If you do not want to take credit risks, select funds which invest primarily in AAA rated papers.

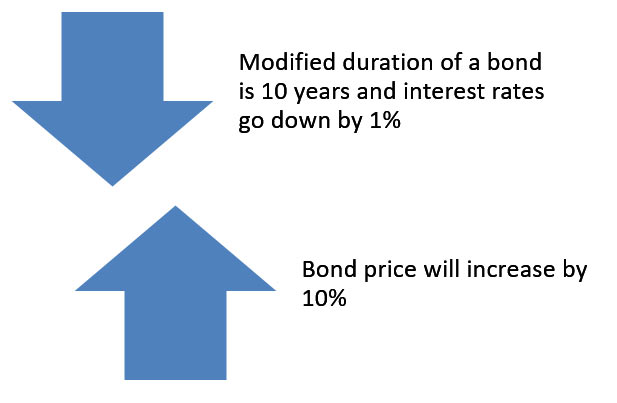

Modified Duration:

Modified duration is simply the price sensitivity of a bond to changes in yields or interest rates.

Modified Duration for Investing

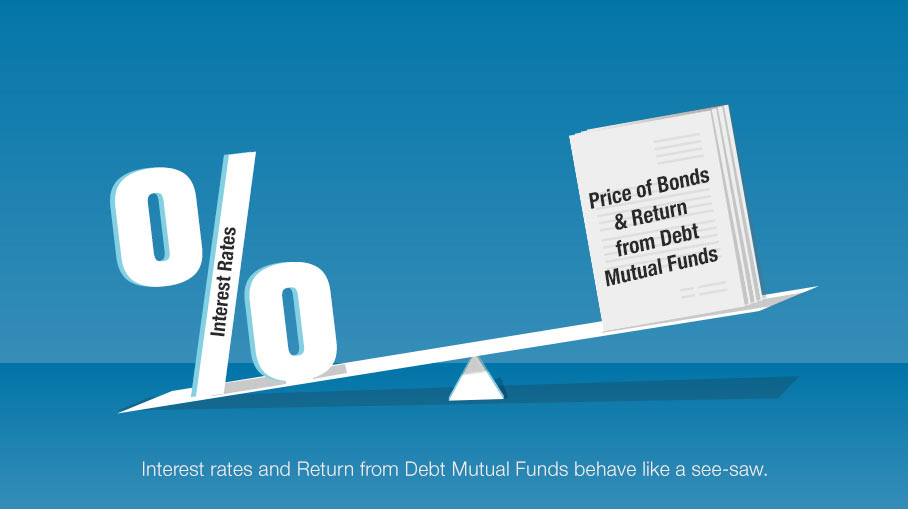

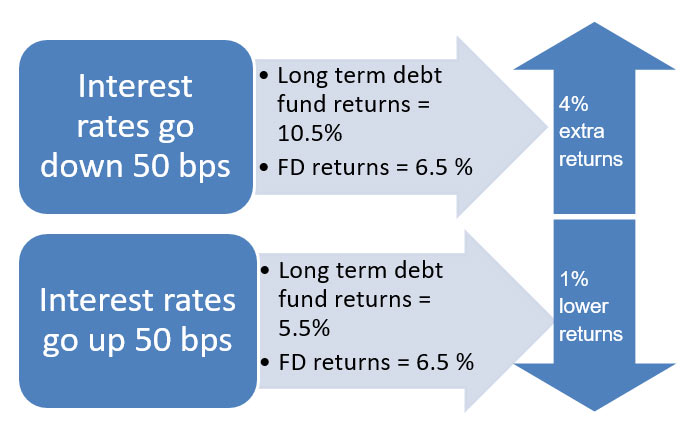

The returns of debt fund and interest rates are inversely related. If interest rates go up, the returns come down and if interest rates go down, the returns increase.

Expected return = YTM + Interest Rate Change X Modified Duration – Expense Ratio

Modified duration |

YTM |

Expense ratio |

Expectation about Interest rates |

Expected returns |

5 yrs |

9% |

1% |

Go down 50 bps |

9%+5%*0.5-1%=10.5% |

5 yrs |

9% |

1% |

Go up 50 bps |

9%-5%*0.5-1%=5.5% |

You should make investment decisions based on risk return trade-offs. Remember risk is always a function of probabilities.

The risk return trade-off is favourable and therefore, you can go ahead with the investment decision.

When to invest, where to invest and when to book profits

Equity valuation index is calculated by assigning equal weights to Price-to-Earning (PE), Price-to-Book (PB), G-sec PE and market cap to GDP ratio.

When the index is neutral, you can add equity in a staggered manner with a long term horizon while maintaining asset allocation.

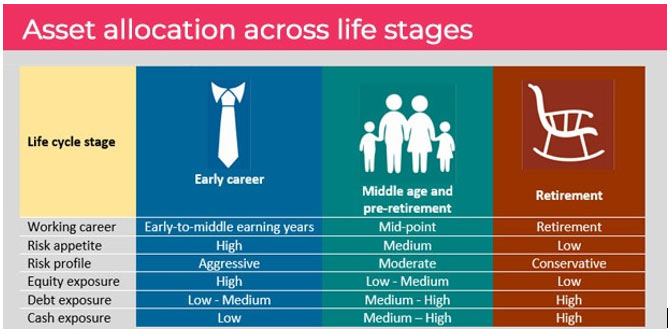

What is Asset Allocation?

Selecting proper asset class for good CAGR (Compounded Annual Growth Rate) returns with safety is a must. And that’s where the skill is required.

To align the portfolio with your investment goals, time frame and risk tolerance (attitude towards risk and return), a balanced asset allocation is must.

The difference between success and failure is not which stock you buy or which piece of real estate you own…

“Asset Allocation” is the key to successful investing

Why Asset Allocation?

Because, the winners keep changing!

Asset Class |

NIFTY 100 TRI |

NIFTY Corporate Bond Index | Gold |

CY 2019 |

11.83% |

9.98% |

21.08% |

CY 2018 |

2.57% |

5.91% |

8.36% |

CY 2017 |

32.88% |

6.49% |

5.95% |

CY 2016 |

5.01% |

10.18% |

10.90% |

CY 2015 |

-1.26% |

8.82% |

-7.88% |

CY 2014 |

34.88% |

11.42% |

2.18% |

CY 2013 |

7.89% |

7.66% |

-17.96% |

CY 2012 |

32.51% |

11.26% |

11.70% |

CY 2011 |

-24.93% |

8.42% |

29.37% |

CY 2010 |

19.28% |

4.34% |

24.19% |

CY 2009 |

84.88% |

9.41% |

19.43% |

CY 2008 |

-53.07% |

11.03% |

28.94% |

CY 2007 |

59.48% |

8.50% |

17.48% |

CY 2006 |

40.24% |

4.09% |

21.14% |

CY 2005 |

37.14% |

6.59% |

21.94% |

Different Asset classes perform differently in different calendar years

Diversification helps in reducing risk.

Portfolio Asset Allocation

Why us?

There are a whole lot of investment options available.

This chart is for indication only. Depending on your goals, risk-reward ratio and time horizon, we can choose funds.

For example, for senior citizens, large cap equity funds and debt funds are suitable as they have very low risk taking ability.

Now-a-days, it's a general trend mostly among youngsters. They go to moneycontrol, zerodha, valuereasearch, see past performance of mutual funds and invest in funds which have good past performance.

Let's take a case where you have to choose a 2023 world cup winning Indian cricket team. Which players would you select?

Kapil Dev, Sachin Tendulkar? Just because they have played really well in the past?

Or someone who has good capabilities like K L Rahul, Virat Kohli, Jaspreet Bumrah etc?

This is where you need our expertise. The thorough research of portfolios, fund managers, current market situations makes us the best choice for selecting funds according to your need.

We can bring a potential difference in your returns. Depending on the market condition, a sound asset allocation strategy and rebalancing of your portfolio is very crucial.

We like certainty

From a psychological perspective, uncertainty exerts an enormous amount of pressure on the human psyche and tends to trigger a fear based response. The obvious way to counteract this is to move towards certainty, in whatever form it takes.

Let us take over your financial worries and give you freedom to pursue your dreams.

You can

- learn a new musical instrument

- give time for gardening

- learn new skills like cooking, dancing, photography, painting

- listen to music

- plan a dream vacation

- go for a trek

- spend Time With Friends and Family

- Exercise

- read

- Volunteer

- watch a movie

Ready to invest?

Pre-requisites for mutual fund investments:

1. Are you KYC compliant?

Check your KYC status here.

If you are not KYC compliant, following are the documents needed for KYC:

- PAN card

- Any one document from passport, Aadhaar card, driving license, voter ID card as an address proof

- Latest photograph

2. Once your KYC is completed, you can start mutual fund investment.

Things required while investing:

- PAN

- Address details

- Bank account number & type

- IFSC code

- E-mail and phone number